|

|

Mar-06-2008FHA, Relic of Past, Is Rebounding(topic overview)

CONTENTS:

- Neither company, however, is authorized to directly lend mortgage money. (More...)

- Mr. Frank, who praised the Fed chairman's "willingness to work with us," proposed legislation last week to allow the F.H.A. to insure up to $20 billion in troubled mortgages if the lenders first agree to forgive a big part of the original loan amounts. (More...)

- One little known provision of the economic stimulus bill enacted in January raises the maximum limits for FHA-backed loans, Egeberg said. (More...)

- Though, real relief for the mortgage market requires stabilization, and then recovery, in the nation's housing sector. (More...)

- The understandable impulse to minimize foreclosures should not be a pretext to prop up the housing market by rescuing too many strapped homeowners. (More...)

- Traditionally, FHA loans were capped at a maximum of $200,160 in Yuma County. (More...)

- Lots of loans were made by the seller down-payment companies. (More...)

- Currently, HUD's non-profit partner NeighborWorks is distributing an additional $180 million in grants for foreclosure prevention counseling. (More...)

- The Federal Housing Administration, a relic of the Great Depression that dwindled to near irrelevance in recent years, is suddenly emerging as the centerpiece of government efforts to prop up the housing market. (More...)

- The Federal Reserve System also is supporting efforts to reach troubled borrowers and to raise awareness in communities about ways to prevent foreclosures. (More...)

- Roughly half of all jumbo mortgages are in California, according to federal regulators. (More...)

SOURCES

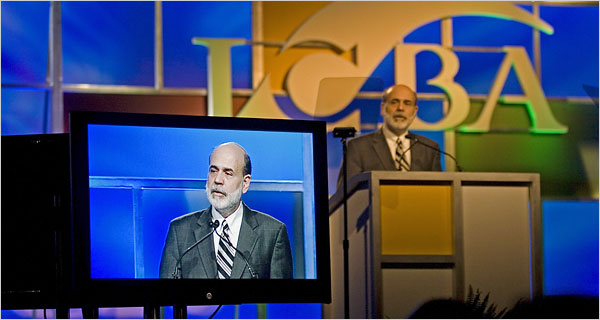

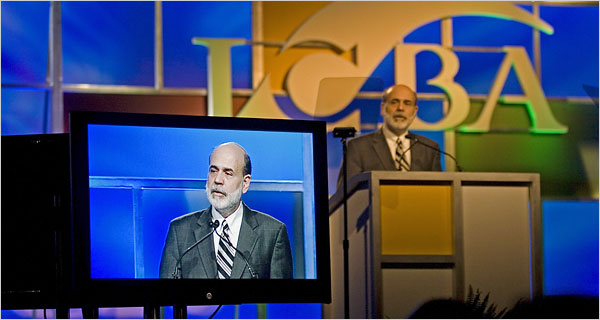

Neither company, however, is authorized to directly lend mortgage money. They buy loans from lenders, put these loans into large packages, then guarantee payment to the people who buy pieces of these packages. Since Fannie Mae or Freddie Mac guarantee these loans, they set the rules lenders must follow called the conforming guidelines. A conforming loan must meet all of these rules including the maximum loan amount, currently $417,000 as set by Congress. Any loan amount over this set limit is called a 'jumbo' loan. Today, no government-sponsored company guarantees jumbo loans and that has resulted in a shortage of money for those loans, similar to the conditions decades ago. Because of the severity of this shortage, interest rates offered on jumbo loans are significantly higher than for conforming loans and borrower qualifying is much more stringent. This is about to change. [1] What seems to confuse most people is when the news is about Fannie Mae, Freddie Mac or conforming and jumbo loans. Let's look at what is about to happen because of this legislation and, along the way, explain what these developments mean to you. When my wife and I started our mortgage careers, decades ago, home loans were made by lenders from the deposits they accepted. As demand increased, these lenders began running out of enough money for new mortgages. To solve this problem, Congress authorized ' and controls ' two companies created to fix the problem, Fannie Mae, an acronym for the Federal National Mortgage Association (FNMA), and Freddie Mac, an acronym for the Federal Home Loan Mortgage Corporation (FHLMC). Both companies were given the mission of providing a steady flow of mortgage money for the national housing market.[1] Ben S. Bernanke, the Fed chairman, told a group of bankers in Florida on Tuesday that "more can and should be done" to help millions of people with mortgages that are often bigger than the value of their homes. Though Mr. Bernanke stopped well short of calling for a government bailout, he used his bully pulpit to try to push the banking industry into forgiving portions of many mortgages and signaled his concern that market forces would not be enough to prevent a broader economic calamity. He also suggested that the Federal Housing Administration expand its insurance program to let more people switch from expensive subprime mortgages to federally insured loans. He urged the two government-sponsored mortgage companies, Fannie Mae and Freddie Mac, to raise more capital so they could buy more mortgages.[2]

The companies already guarantee or hold as investments about $1.5 trillion in mortgages. The Bush administration, despite its public opposition to bailouts, has set the stage for a bigger government role. One month ago, President Bush signed an economic stimulus bill that greatly increased the size of loans the F.H.A. can insure, while allowing Fannie Mae and Freddie Mac to purchase significantly larger mortgages from lenders and guarantee them against default by homeowners.[2] The upper mortgage limits also will apply to loans purchased or guaranteed by government-sponsored mortgage companies Fannie Mae and Freddie Mac, FHA officials said.[3] Historically, the F.H.A. and the mortgage companies have focused on conservative mortgages for people borrowing relatively modest sums. They are now being encouraged to finance much bigger mortgages, in some cases to people who put almost no money down. Last week, the administration went further by removing limits on the volume of mortgages that Fannie Mae and Freddie Mac can hold in their own portfolios. That means the two companies could buy up billions of dollars in mortgages that other investors have been too frightened to touch.[2] The move, which administration officials had previously opposed, increases the limits on F.H.A., Freddie Mac and Fannie Mae mortgages from $417,000 to as much as $729,750.[2] The package also includes a temporary increase in the cap on mortgages that the government-sponsored mortgage companies Fannie Mae and Freddie Mac can buy or guarantee from $417,000 to $729,750.[4]

Now, Egeberg said, a borrower with a credit score of under 620 would be charged a 2 percent penalty fee that would amount to an additional $4,000 on a $200,000 house. Borrowers would pay the one-time fee when their mortgage is bought by Fannie Mae or Freddie Mac to be sold on the secondary investment market. Those who don't pay the fee would be faced with higher interest rates. "There will be a window of people who previously would have qualified who no longer will because of this," he said. This is where the good news comes in.[5] After suffering major losses stemming from the high foreclosure and delinquency rates in the mortgage market, Fannie Mae and Freddie Mac have announced "loan-level price adjustments." What that means is that borrowers with credit scores of less than the sterling 680 will be charged "penalties" that could add thousands of dollars to the cost of purchasing a home, said Derek Egeberg, a senior loan officer with Territorial Mortgage Co. Other mortgage officers could not be reached before the weekend for comment.[5]

Congress must act now," Jackson stressed. Jackson also explained how the Bush Administration's aggressive efforts are keeping hundreds of thousands of families in their homes. The Secretary pointed to FHASecure, the refinancing arm of FHA, which has helped more than 100,000 homeowners refinance their mortgage since it was announced last fall. FHASecure includes homeowners who are current on their loan or past due because their teaser rates reset; some borrowers who owe more on their homes than they are worth; and those in the process of foreclosure. Families are saving an average of $400 a month compared to the cost of their previous exotic subprime loans.[6] The HOPE NOW Alliance, representing 90 percent of the subprime market, has also responded to the Bush Administration's call for action and is helping homeowners in need of mortgage relief. Formed by Jackson and Treasury Secretary Henry Paulson, HOPE NOW has implemented a plan that makes more than one million people eligible to modify their home loans, refinance into FHASecure, or have their interest rates temporarily frozen. Recently, HOPE NOW introduced Project Lifeline, which makes thousands of at-risk borrowers eligible for a pause in the foreclosure process while servicers try to modify their loans. "I am pleased by their actions.[6]

SAN FRANCISCO, CA - Tens of thousands of California families could benefit from affordable government-insured mortgages under a plan to be announced shortly that will temporarily increase home loan limits, U.S. Department of Housing and Urban Development Secretary Alphonso Jackson said. Highlighting the Bush Administration's plans to help Americans keep their homes, Jackson said the President's economic growth package, which became law last month with wide bipartisan support, could allow more than 30,000 California families to be eligible over the next several months for safe, affordable mortgages insured by HUD's Federal Housing Administration (FHA).[6] We estimate that nearly 33,000 Californians will benefit over the next 18 months," Jackson said in speech to the Commonwealth Club of California. This week, FHA will publish temporary loan limits that will range from $271,050 to $729,750. This increase will help provide economic stability to communities in California and give hundreds of thousands of homeowners and homebuyers throughout the country a safer, more affordable mortgage alternative.[6]

Loans above the previous limit are regarded as "jumbo" mortgages which carry a higher interest rate. The Federal stimulus package signed by President Bush in early February raises conventional and FHA loan limits to $729,750, in large measure to stimulate home sales and refinancing in high-cost areas such as California, Connecticut, Massachusetts, New York, and the Washington, DC area.[7] NEW YORK, March 4 /PRNewswire/ -- Refinance.com, the nation's premier source for residential mortgage refinancing, has announced new higher mortgage loan limits up to $729,750 for a single family home, stated Nicholas Bratsafolis, chairman and CEO of Refinance.com. The company is taking the lead nationally in refinancing for homeowners by immediately adopting the new conforming and FHA loan limits and is accepting mortgage refinance applications up to these new limits immediately. "Borrowers all over the country can take advantage of these new higher loan limits, particularly in high cost areas. These new higher loan limits provide breathing room for homeowners who have jumbo mortgage loans and have recently been shut out of the refinancing market. We urge all homeowners with adjustable rate mortgages, or loans over $417,000, to contact their lenders and inquire about refinancing programs before these limits expire," said Mr. Bratsafolis.[7]

Currently, FHA loan limits are capped at $362,790. These higher loan limits are temporary and expire at the end of 2008. President Bush and Jackson continue to call on Congress to pass a permanent bipartisan solution to help more families quality for FHA-insured mortgages, which allow low-income, minority and first-time homeowners access to prime-rate financing so they afford to purchase a home.[6] Legislation, which has been pending in Congress for two years, offers flexible downpayment requirements, permanent loan limits higher than the current amount of $362,790, and fairly-priced insurance premiums. "FHA modernization could help a quarter of a million families this year alone. It passed the House and Senate in overwhelmingly bipartisan fashion.[6]

Previously, the loan limit had been $417,000 for conventional conforming single family mortgages, and $362,790 for FHA insured single family mortgages.[7]

HUD oversees the Federal Housing Administration, an agency created during the Depression to stimulate home ownership. To increase liquidity, FHA buys and insures bank-issued, fixed-rate mortgages for challenged borrowers, but it is confined to loans of less than $362,790, which is why it has only a minimal presence in high-cost states such as California.[8] Even without new legislation, the Federal Housing Administration has been active. It has insured 110,000 mortgage refinancings worth $15 billion since it started a program, F.H.A. Secure, in October. It is hard to know how many of the loans would have come to the agency because of the mortgage crisis, but officials estimate as many as 90 percent of the borrowers were previously in subprime loans.[2] FHA loans are loans that are insured by the Federal Housing Administration, meaning that there is less risk to the lender if the borrower defaults on the loan because the FHA mortgage insurance will pay for a portion of the lender's loss.[9] Some measures being considered by Congress (for example: overhauling the Federal Housing Administration ) might help. Other proposals -- particularly empowering bankruptcy judges to reduce mortgages unilaterally -- would perversely hurt the housing market by raising the cost of mortgage credit. Lenders would increase interest rates or down payments to compensate for the risk that a court might modify or nullify their loans.[10] Separately, on Monday, Hope Now, the administration's foreclosure prevention coalition with lenders, said it had reworked more than 1 million mortgages for at-risk homeowners since July. About a quarter of them were loan modifications, in which lenders froze or reduced interest rates.[8]

The idea is to stoke investor demand for securities made up of more expensive mortgages -- so-called jumbo loans -- backed by Fannie and Freddie, the two biggest mortgage financers in the country. That would drive interest rates lower and spur home buying and refinancing.[4]

Within a couple of months, the maximum conforming loan amount authorized by Congress in the economic stimulus package will increase to $729,750 for most of California through December 2008. This will mean buying a home or refinancing a mortgage over the old $417,000 limit will become much easier.[1] The economic stimulus package includes a temporary increase in the limit on FHA-backed loans, from $362,790 to as high as $729,750 in expensive areas, to let more homeowners with high-rate subprime mortgages refinance into federally insured loans.[4]

The FHA loan limit for other "high-cost" areas in the lower-48 states will also rise to $729,750, more than twice as much as the old loan limit of $362,790.[7]

HUD wants to update the program by increasing the FHA's loan limits; matching insurance premiums with a borrower's credit profile instead of charging flat rates; and eliminating the 3 percent down payment requirement. (A temporary increase in FHA loan limits is part of the economic stimulus act signed by the president in February, but it lasts only until year's end.)[8] The new limit would be in effect through the end of the year. "A lot of new subdivisions could immediately go to FHA," he said, adding that he would like to see 50 percent of new home loans for the remainder of the year go with FHA. That would put more people into houses that now are sitting on the market, he said. It would provide for safer loans so fewer people would get in over their heads with a mortgage. "If the buyer isn't looking at FHA, they're not getting the best advice from their mortgage officer," Egeberg said.[5] Last week, the Governor met with U.S. Department of Housing and Urban Development Secretary Alphonso Jackson in Washington D.C. to discuss raising federal loan limits permanently. The Governor sent a letter earlier this year urging Congress to approve increased home mortgage loan limits and he sent a similar letter last fall.[11] The government on Wednesday raised the mortgage limits for loans guaranteed by the Federal Housing Administration in 14 high-cost California counties.[4] The Federal Housing Administration raised the mortgage limits to a maximum of $729,750 for 14 high-cost counties in California, as the government began providing aid to homeowners required by the recently enacted economic-stimulus package.[3]

The Federal Housing Administration, a Depression-era agency within HUD, insures mortgages for low- and middle-income borrowers.[4]

The other option is to switch to Federal Housing Administration (FHA) backed loans.[9]

Because the FHA loan limits didn't reflect the housing market in California and other high-cost states, a vacuum was created that was filled by exotic subprime loans.[6] "The plan raises FHA's loan limits, enabling more families to qualify for a safe, affordable FHA mortgage. This is critical for California, where most families are currently priced out of FHA loans.[6]

The Department of Housing and Urban Development released the new loan limits for California -- a hotbed during the housing boom that now is suffering the worst home-price declines in the nation.[4]

Loan limits will be set at 125 percent of the median sales price for the area.[6] With the run-up in homes sales prices over the past couple of years, many loans exceeded that amount. While the new limits haven't been officially announced yet, Egeberg said he anticipates it could go to $271,050 for Yuma County to reflect the rising cost of houses.[5] At the other end, Lassen, Modoc and Trinity counties are subject to a loan cap of $271,050 -- a standard amount in an area with normal home prices.[4]

Counties that get the $729,750 maximum for FHA loans are likely to get that same level for Fannie and Freddie mortgages, experts said.[4] Fannie now seems to be going out on a similar lending limb. The company is offering borrowers who are behind with mortgage payments up to $US15,000 each to clear their arrears. The money comes get this as a 15-year unsecured personal loan, with "verbal confirmation of financial capacity" acceptable, according to Fannie's published details.[12] As it happens, it will also reduce the number of delinquent loans Fannie buys back from the pools underlying mortgage-backed securities it guarantees and the related losses it would otherwise have to take. That's a nice kicker for Fannie, which has already had to raise one big batch of new capital to cover billions in write-downs. For borrowers, Fannie says, the programme is a way to "bring delinquent mortgages current and keep their homes". That's true, provided they can afford the regular payments on their mortgage and those on the new loan, which kick in after six months. That may be fine for borrowers in truly temporary difficulty. Longer term, it's going to increase, not reduce, their debt burden.[12]

In many cases, everyone would gain if lenders and borrowers renegotiated loan terms to reduce monthly payments. Losses to both would be less than if their homes went into foreclosure and were sold.[10] Home loans insured by the FHA have become the cheapest and, in many cases, the only alternative for borrowers who can make only a small down payment.[13]

FHA Insured fixed rate mortgages can relieve the uncertainty that many Americans have faced with the possibility of foreclosure, as monthly variable mortgage costs rise to high levels. Refinance.com also offers borrowers the most comprehensive refinancing programs for their homes under both conventional and FHA programs.[7] Reducing the rate of preventable foreclosures would promote economic stability for households, neighborhoods, and the nation as a whole. Although lenders and servicers have scaled up their efforts and adopted a wider variety of loss-mitigation techniques, more can, and should, be done. The fact that many troubled borrowers have little or no equity suggests that greater use of principal writedowns or short payoffs, perhaps with shared appreciation features, would be in the best interest of both borrowers and lenders. This approach would be facilitated by allowing the FHA the flexibility to offer refinancing products to more borrowers.[14]

Important is that we've gotten the (lending) industry to work with us to help people. (The administration has said banks agreed to freeze interest rates for some borrowers and to temporarily halt foreclosure proceedings for others.)[8] In addition to sharply cutting interest rates, the Fed has lent more than $160 billion to banks since mid-December through a new program, the Term Auction Facility.[2]

Mr. Frank, who praised the Fed chairman's "willingness to work with us," proposed legislation last week to allow the F.H.A. to insure up to $20 billion in troubled mortgages if the lenders first agree to forgive a big part of the original loan amounts. [2] Fannie Mae and Freddie Mac can borrow money more cheaply than private banks largely because of the assumed government backing. The Fed has been offering its own resources to soften the credit squeeze that began when investors started to panic about subprime loans.[2] The agency is rapidly gaining market share as government-sponsored mortgage investors Fannie Mae and Freddie Mac, stung by combined losses of about $9 billion in last year's second half, back away from credit risks by adding fees and demanding higher.[13] The government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, likewise could do a great deal to address the current problems in housing and the mortgage market. New capital-raising by the GSEs, together with congressional action to strengthen the supervision of these companies, would allow Fannie and Freddie to expand significantly the number of new mortgages that they securitize. With few alternative mortgage channels available today, such action would be highly beneficial to the economy.[14] Particularly vulnerable would be Fannie Mae and Freddie Mac, the two government-sponsored housing lenders (their vulnerability emphasizes the need for Congress to pass legislation strengthening regulation of Fannie and Freddie).[10] Borrowers will have to make a 5% down payment to get Fannie or Freddie backed financing in a declining market, and many would-be buyers simply do not have 5% to put down. Since the declining market designation was started by Fannie Mae, the simplest way to get away from this designation is to get away from Fannie Mae financing. For some, this may just involve switching to Freddie Mac, although I am told that Freddie Mac is revising its automated underwriting system to reflect declining markets as well.[9] Remember 'Ninja' mortgages no income,no job, no assets? And 'liar loans', with no check of borrowers' stated incomes? Staid old Fannie Mae and Freddie Mac, the government-chartered U.S. mortgage giants, were supposed to have shunned such sub-prime excesses. Maybe they did.[12]

Thank you for your question. It is nice and simple, and incredibly timely, and I will try to give a simple, straightforward and timely answer. For those who do not know, Fannie Mae, the originator of most of the mortgage loan money in the United States, recently reprogrammed its automated underwriting system to flag certain geographic regions as "declining markets" (or "D Markets" in shorthand).[9] Can someone please clarify? I didn't know that Fannie Mae was a loan originator as referenced in this article.[9]

For Fannie, the 'HomeSaver Advance' programme should help reduce the need to modify mortgage loans formally, a complicated and expensive process, and to foreclose, a bad result all round.[12] No other state has been more impacted by the ongoing mortgage crisis than California and the announcement today by the federal government will help more working Californians achieve the American dream of homeownership through less expensive and more secure loans.[11] California Gov. Arnold Schwarzenegger said the new limits will "help California's housing market rebound." "No other state has been more impacted by the ongoing mortgage crisis than California, and the announcement today. will help more working Californians achieve the American dream of homeownership through less expensive and more secure loans," he said in a statement.[4] 'I applaud the Administration's swift action to help California's housing market rebound.[11]

Alphonso Jackson, secretary of the U.S. Department of Housing and Urban Development, is in California this week to discuss the Bush administration's response to the foreclosure crisis. He'll address the Commonwealth Club in San Francisco today, then travel to Southern California to visit community groups.[8] WASHINGTON - However much they might oppose it on ideological grounds, the Bush administration and the Federal Reserve are inching closer toward a government rescue of distressed homeowners and mortgage lenders.[2] Since July, the community affairs groups across the Federal Reserve System have sponsored or cosponsored more than fifty events related to foreclosures, reaching more than 4,000 attendees including lenders, counselors, community development specialists, and policymakers. We are also concerned about the challenges of neighborhoods that have seen large increases in foreclosures and vacant properties and have begun to work with policymakers, lenders (including community banks) and community groups to address these problems.[14] The Federal Reserve can help by leveraging three important strengths: our analytical and data resources; our national presence; and our history of working closely with lenders, community groups, and other local stakeholders.[14]

To stress the importance of housing counseling, Jackson pointed to studies that show homeowners in need of financial help responding more quickly to community and non-profit groups than to lenders and banks.[6]

HUD Secretary Alphonso Jackson said Wednesday the new limits will make FHA-backed loans available to as many as 30,000 Californians and 250,000 homeowners nationwide.[4] The new limits "will allow for greater economic stability for our communities," Jackson said in a speech in Los Angeles. A text of his remarks was distributed by HUD.[4]

One little known provision of the economic stimulus bill enacted in January raises the maximum limits for FHA-backed loans, Egeberg said. [5] With the economic stimulus package, that can go to $729,000, which will help people in California and the East Coast. A: They (were) available as of (March 2).[8] By : Staff : 3/4/08 Just about everyone, by now, is aware that the economic stimulus package signed on Feb. 13. Part of this package was specifically designed to help the housing market.[1]

Though, real relief for the mortgage market requires stabilization, and then recovery, in the nation's housing sector. Modernization of the FHA would be of help on this front as well. I am sure that the FHA and the Department of Housing and Urban Development, given the appropriate powers by the Congress, will make every effort to expand their operations and to help improve the functioning of the market for home-purchase mortgages. [14] We recently assisted NeighborWorks America in identifying regions and neighborhoods that are at risk of higher rates of foreclosure and could benefit from increased mortgage counseling capacity. On the basis of this analysis, NeighborWorks recently distributed $130 million in newly granted funds from Congress to thirty-two state housing finance agencies, eighty-two community-based NeighborWorks organizations, and sixteen counseling intermediaries around the country.[14]

Through FHA refinancing programs provided by Refinance.com, many homeowners will be able to refinance with long term fixed rate mortgages, not previously available.[7] About Refinance.com: Refinance.com is one of the nations leading mortgage companies with nearly twenty years of mortgage refinancing expertise. The company has assisted thousands of clients reach their home refinancing goals through its diverse range of mortgage and refinancing options, and specializes in FHA mortgage lending.[7]

Hundreds of billions of dollars of other losses are already being suffered by builders (from the lower value of land and home inventories), mortgage lenders (from defaulting loans), speculators and homeowners (from lost homes). Mark Zandi of Moody's Economy.com estimates that mortgage defaults this year will exceed 2 million, up from 893,000 in 2006. To be sure, all this weakens the economy. No one relishes evicting hundreds of thousands of families from their homes.[10] More foreclosures depress prices, increasing foreclosures as people abandon houses where the mortgage exceeds the value. Losses to banks and other lenders rise, and they curb lending further.[10] We want safer mortgages. That's why we go out of our way when people (face) foreclosure to work with them.[8]

The understandable impulse to minimize foreclosures should not be a pretext to prop up the housing market by rescuing too many strapped homeowners. Though cruel, foreclosures and falling home values have the virtue of bringing prices to a level where housing can escape its present stagnation. [10] The limits, with the maximum at $729,750, are derived from median home prices in each county.[4]

Traditionally, FHA loans were capped at a maximum of $200,160 in Yuma County. [5] "FHA loans are solid, safe, secure loans." They also require a 3 percent down payment versus 5 percent for conventional loans.[5] Borrowers pay insurance premiums of 1.5 percent of the loan value up front plus 0.5 percent of each monthly payment for a certain time.[8]

Lots of loans were made by the seller down-payment companies. They did not check credit. [8]

When it comes to home mortgages these days, there's bad news but there's also some good news for potential buyers. The bad news is that borrowers without squeaky clean credit scores will be paying an additional "risk" fee for their mortgages.[5] Under the program, banks have been able to borrow money for up to a month or so, pledging collateral that includes mortgage-backed securities, even if the securities are not tradable in today's markets. In Congress, Democratic lawmakers pounced on Mr. Bernanke's comments in Orlando, Fla., to bolster their arguments for much costlier rescue plans. "It is now clear that we will not be able to avert a more serious and prolonged economic slowdown if we don't address the problem of increasing mortgage foreclosures," Representative Barney Frank, chairman of the House Financial Services Committtee, said on Tuesday.[2] The programme might also upset investors in the company's MBS instruments. They like the idea that Fannie has to buy back troubled individual mortgages under certain conditions.[12] The declining market flag is something that would be found by the lender when s/he runs the property address through the Fannie Mae automated underwriting system.[9] The days of 100% financing backed by Fannie and Freddie Mac are over for properties in a declining market.[9]

Currently, HUD's non-profit partner NeighborWorks is distributing an additional $180 million in grants for foreclosure prevention counseling. "More than half of all homeowners in foreclosure did not discuss it beforehand with their servicer or lender. We must change this attitude. [6] We're letting the American people know about it, sending letters out to 850,000 homeowners with resetting rates, including 54,000 Californians, who might qualify for FHA," Jackson added.[6] Some months ago, in August, I announced FHA Secure. It simply says that if a person has paid their house note on a timely basis until the teaser rate jumped substantially, we're willing to work with those persons to make sure they stay in their homes. We have had over 300,000 applications and have helped finance 100,000 people to stay in their homes.[8]

The Federal Housing Administration, a relic of the Great Depression that dwindled to near irrelevance in recent years, is suddenly emerging as the centerpiece of government efforts to prop up the housing market. [13] The Bush Administration has increased funding for housing counseling by 150 percent since 2001.[6]

The Federal Reserve System also is supporting efforts to reach troubled borrowers and to raise awareness in communities about ways to prevent foreclosures. [14] I would like to comment briefly on Federal Reserve System efforts to reduce preventable foreclosures and their costs on borrowers and communities.[14]

Roughly half of all jumbo mortgages are in California, according to federal regulators. [4]

SOURCES

1. Loyal Subscriber Site

2. Bush and Fed Step Toward a Mortgage Rescue - New York Times

3. Free Preview - WSJ.com

4. 14 Calif. counties get maximum FHA limit

5. News: Good news, bad news in the mortgage market | loans, mortgage, fha : YumaSun

6. Tens of Thousands Could Benefit from Higher Government-Insured Mortgage Limits - Originator Times

7. Refinance.com :: Refinance.com Announces New Higher Mortgage Loan Limits to $729,750

8. HUD secretary discusses foreclosure fixes

9. So long Fannie, hello FHA! - Business

10. Robert J. Samuelson - The Housing Fix - washingtonpost.com

11. Trend News : Schwarzenegger Applauds Federal Announcement of Higher Loan Limits in 14 California Counties

12. Business Spectator - Lying to Fannie Mae

13. Free Preview - WSJ.com

14. TEXT-Bernanke's speech to community bankers | Reuters

Get more info on FHA, Relic of Past, Is Rebounding by using the iResearch Reporter tool from Power Text Solutions.

|

|  |

|